On Wednesday, the European Central Bank announced that it would no longer accept Greek government debt as collateral for loans. This move, it turns out, was more symbolic than substantive. Still, the moment of truth is clearly approaching.

And it’s a moment of truth not just for Greece, but for the whole of Europe — and, in particular, for the central bank, which may soon have to decide whom it really works for.

Basically, the current situation may be summarized with the following dialogue:

Germany to Greece: Nice banking system you got there. Be a shame if something were to happen to it.

Greece to Germany: Oh, yeah? Well, we’d hate to see your nice, shiny European Union get all banged up.

[quote text_size=”small”]

Or if you want the stuffier version, Germany is demanding that Greece keep trying to pay its debts in full by imposing incredibly harsh austerity. The implied threat if Greece refuses is that the central bank will cut off the support it gives to Greek banks, which is what Wednesday’s move sounded like but wasn’t. And that would wreak havoc with Greece’s already terrible economy.

[/quote]

Yet pulling the plug on Greece would pose enormous risks, not just to Europe’s economy, but to the whole European project, the 60-year effort to build peace and democracy through shared prosperity. A Greek banking collapse would probably lead Greece to leave the euro and establish its own currency — and if even one country were to abandon the euro, investors would be put on notice that Europe’s grand currency design is reversible.

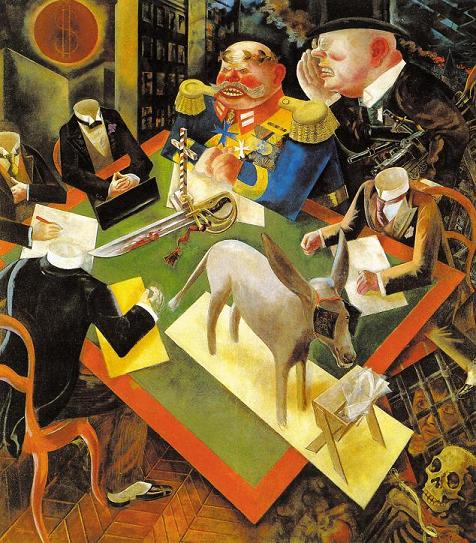

Beyond that, chaos in Greece could fuel the sinister political forces that have been gaining influence as Europe’s Second Great Depression goes on and on. After a tense meeting with his German counterpart, the new Greek finance minister didn’t hesitate to play the 1930s card. “Nazism,” he declared, “is raising its ugly head in Greece” — a reference to Golden Dawn, the not-so-neo-Nazi party that is now the third largest in the Greek legislature.

What we’re looking at here is, in short, a very dangerous confrontation. This isn’t diplomacy as usual; this is a game of chicken, of two trucks loaded with dynamite barreling toward each other on a narrow mountain road, with neither willing to turn aside. And all of this is taking place within the European Union, which is supposed to be — indeed, has been, until now — an institution that promotes productive cooperation.

How did Europe get to this point? And what’s the end game?

Like all too many crises, the new Greek crisis stems, ultimately, from political pandering. It’s the kind of thing that happens when politicians tell voters what they want to hear, make promises that can’t be fulfilled, and then can’t bring themselves to face reality and make the hard choices they’ve been pretending can be avoided.

I am, of course, talking about Angela Merkel, the German chancellor, and her colleagues.

It’s true that Greece got itself into trouble through irresponsible borrowing (although this irresponsible borrowing wouldn’t have been possible without equally irresponsible lending).

[quote text_size=”small”]

And Greece has paid a terrible price for that irresponsibility. Looking forward, however, how much more can Greece take? Clearly, it can’t pay the debt in full; that’s obvious to anyone who has done the math.

[/quote]

Unfortunately, German politicians have never explained the math to their constituents. Instead, they’ve taken the lazy path: moralizing about the irresponsibility of borrowers, declaring that debts must and will be paid in full, playing into stereotypes about shiftless southern Europeans. And now that the Greek electorate has finally declared that it can take no more, German officials just keep repeating the same old lines.

Maybe the Germans imagine that they can replay the events of 2010, when the central bank coerced Ireland into accepting an austerity program by threatening to cut off its banking system. But that’s unlikely to work against a government that has seen the damage wrought by austerity, and was elected on a promise to reverse that damage.

Furthermore, there’s still reason to hope that the European Central Bank will refuse to play along.

On Wednesday, the central bank made an announcement that sounded like severe punishment for Greece, but wasn’t, because it left the really important channel of support for Greek banks (Emergency Liquidity Assistance — don’t ask) in place. So it was more of a wake-up call than anything else, and arguably it was as much a wake-up call for Germany as it was for Greece.

And what if the Germans don’t wake up? In that case we can hope that the central bank takes a stand and declares that its proper role is to do all it can to safeguard Europe’s economy and democratic institutions — not to act as Germany’s debt collector. As I said, we’re rapidly approaching a moment of truth.

Το άρθρο του Νομπελίστα Οικονομολόγου Paul Krugman δημοσιεύεται στην ρφημερίδα “THE NEW YORK TIMES”